By Ryan Faughnder

Los Angeles Times

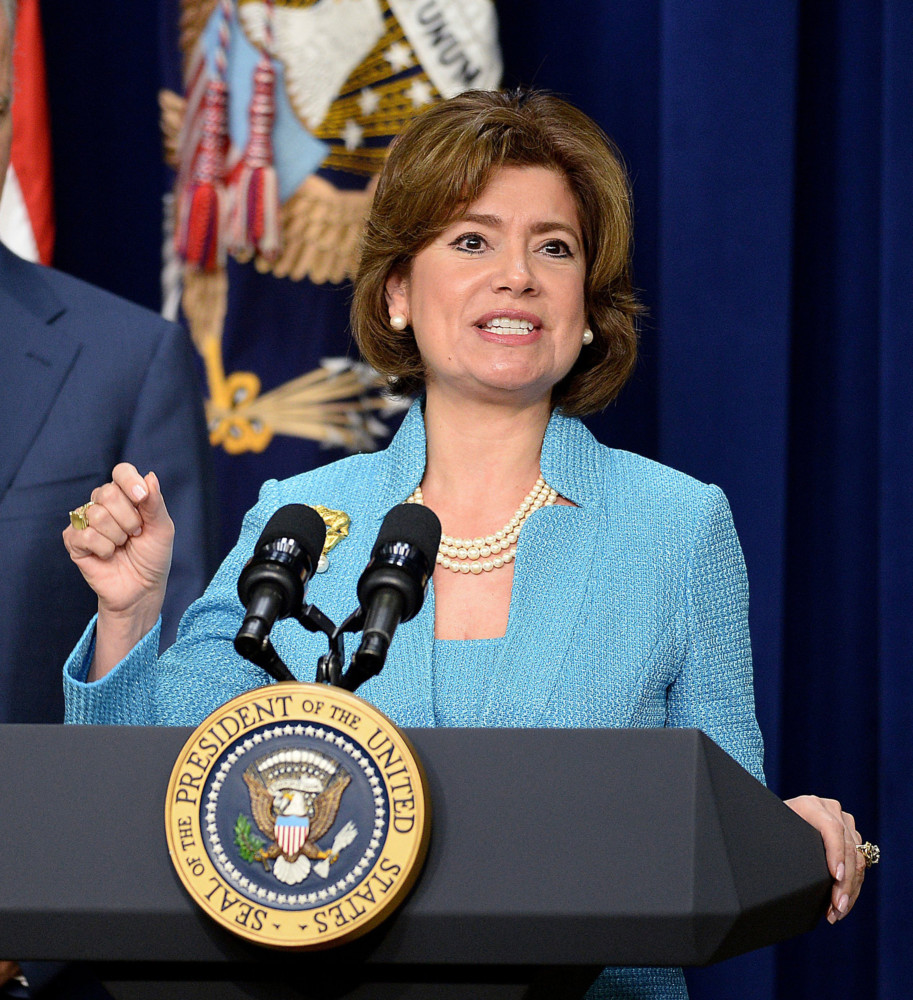

WWR Article Summary (tl;dr) Promising a new era for Weinstein Co., Maria Contreras-Sweet’s plan would rename the company and install a new board of directors, the majority of which would be composed of women.

Los Angeles Times

The saga over the future of Harvey Weinstein’s once-influential studio took a new and surprising turn Thursday when an investor group said it had reached an agreement to buy the struggling company’s assets, nearly five months after sexual abuse allegations against Weinstein sent the company into a death spiral.

An investor group led by former U.S. Small Business Administration head Maria Contreras-Sweet and billionaire Ron Burkle has reached an agreement in principle to purchase assets of Weinstein Co., the onetime Obama administration official said Thursday.

The deal is subject to a 40-day closing period, one person familiar with the matter said.

“Our team is pleased to announce that we have taken an important step and have reached an agreement to purchase assets from The Weinstein Company in order to launch a new company, with a new board and a new vision that embodies the principles that we have stood by since we began this process last fall,” Contreras-Sweet said in a statement.

Promising a new era for Weinstein Co., Contreras-Sweet’s plan would rename the company and install a new board of directors, the majority of which would be composed of women.

Contreras-Sweet did not disclose financial details of the agreement. People familiar with the talks previously said the bid was worth $500 million, including $225 million in assumption of debt.

Representatives for Weinstein Co. and the New York attorney general’s office did not immediately respond to requests for comment.

The announcement marked a stunning reversal from just a few days earlier when it appeared that the New York studio was headed to U.S. Bankruptcy Court after the company’s board said the deal was off the table. The directors said Sunday that the company would prepare to file for bankruptcy in the “coming days.”

The board had blasted the prospective buyers, saying they had refused to provide interim financing to keep the company afloat and would saddle the studio with liabilities. Few insiders thought there was much of a chance that a deal could be salvaged.

But the sale talks were revived Thursday at a last-ditch meeting between the investor group and Weinstein Co.’s board of directors at the office of the New York Atty. Gen. Eric Schneiderman, who sharply criticized the planned sale last month.

The focus of the meeting was to come up with an agreement that would keep the studio afloat as the buyers try to close the sale, according to people familiar with the matter who were not authorized to comment.

Burkle, who has had ties to the Weinsteins, had requested the meeting and was key to resurrecting the deal, sources said. Board members Bob Weinstein, who is Harvey’s brother, Lance Maerov and Tarak Ben Ammar also attended the meeting.

All sides were motivated to prevent a bankruptcy, which probably would have resulted in Harvey Weinstein’s accusers taking a back seat to the company’s secured creditors, which were owed millions of dollars.

The bidders were close to a deal in early February, but negotiations came to a halt after Schneiderman railed against the sale, saying any deal would have to adequately compensate victims, protect future employees and not enrich people he said were complicit in Weinstein’s abuses. The attorney general’s office sued the Weinstein Co. and the Weinstein brothers for civil rights violations.

To help address Schneiderman’s concerns, the bidders have promised a fund for Weinstein’s accusers totaling $90 million. That fund includes $40 million to $50 million that would be raised by selling off Weinstein Co. film projects, plus insurance policies and a $10-million line of credit.

The board fired Chief Operating Officer and President David Glasser “for cause” Feb. 16 in an effort to salvage the deal talks. Glasser threatened to sue for wrongful termination.

Weinstein Co. has been searching for a financial savior since its former co-chairman was accused of sexual harassment and assault against dozens of women. Harvey Weinstein, who was fired from the company Oct. 8, has denied all allegations of nonconsensual sex.

The Weinstein scandal triggered the #MeToo movement against sexual harassment that spanned industries and political spheres, but especially in entertainment, where high-profile men including TV broadcasters Matt Lauer and Charlie Rose and former Amazon Studios head Roy Price were ousted from their jobs because of sexual misconduct allegations.

The allegations against Harvey Weinstein turned an already precarious financial situation for Weinstein Co., which had struggled for years under a heavy debt burden, mismanagement and a lack of hit films, into a desperate one.

Weinstein Co. tried and failed to secure financial lifelines from investors such as Thomas Barrack’s Colony Capital.

Weinstein and his studio have been hit with a barrage of lawsuits, some of which accused the company of negligence for failing to stop the mogul’s conduct.

buy priligy online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/priligy.html no prescription

Weinstein Co. recently asked a judge to dismiss a federal class-action lawsuit against the company filed in December that described a massive scheme that the plaintiffs’ lawyers say facilitated predatory behavior by Weinstein.

Weinstein Co. said that Harvey Weinstein acted alone in his alleged abuses and that most of the incidents occurred more than a decade ago. He also faces multiple criminal investigations in New York, Los Angeles and London.

Contreras-Sweet’s offer for the company, which first came to light in November, represented a surprise chance for survival for the studio and the roughly 130 employees who are believed to remain.

Bids came due in late December. Santa Monica, Calif., studio Lionsgate, known for “La La Land” and “The Hunger Games,” was interested in buying certain assets of the company.

Killer Content, the New York production company behind “Carol” and “Still Alice,” had offered to buy the assets and remake them into an entity to support women. Other bidders included Miramax (owned by BeIN Media) and private equity firms Shamrock Capital Advisors and Vine Alternative Investments.