By Keith Eddings

The Eagle-Tribune, North Andover, Mass.

WWR Article Summary (tl;dr) Entrepreneur Danaris Mazara shares her inspirational story of success and how the SBA played a critical role in helping her along the way.

LAWRENCE

A difficult pregnancy about 10 years ago left Danaris Mazara unable to work. At about the same time, her husband was laid off from his manufacturing job at Haverhill Paperboard.

Bankruptcy followed, then foreclosure.

At one point, Mazara’s mother gave her $35 to buy groceries. Instead, she bought the sugar and other ingredients to bake flan, a popular Dominican sweet treat, which she sold to friends and former co-workers. The sales gave her the money to buy more ingredients. Within two weeks, the $35 grew to $500.

Also growing was a business plan for what became Sweet Grace Heavenly Cakes, a bakery that Mazara moved from the Cambridge Street home she bought in 2012 to an Essex Street storefront she bought in 2015.

Most of the $160,000 cost of the storefront came from an Eastern Bank loan backed by the federal Small Business Administration, which supports start-ups and existing businesses that don’t have the credit ratings needed for regular commercial bank loans. Another $37,000 came from the Lawrence Partnership and Mill City Community Investments, two nonprofits that support economic development and job growth in the region.

Mazara, a native of the Dominican Republic, now employs nine people, including her husband.

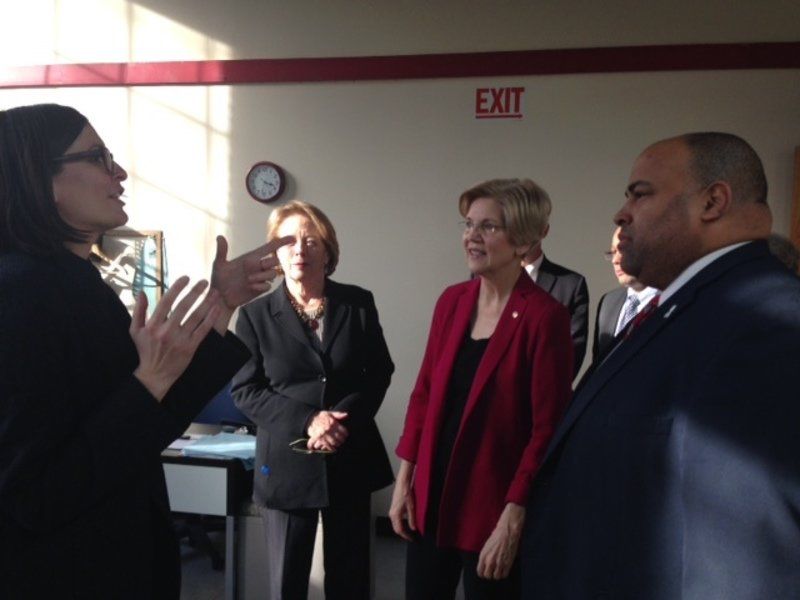

Her immigrant success story would have been impossible without the SBA loan that allowed her to buy the storefront at 98 Essex St., Mazara on Friday told a roomful of some of the most powerful people in Washington, Boston and Lawrence, including U.S. Sen. Elizabeth Warren, Rep. Niki Tsongas, D-Lowell, Mayor Daniel Rivera and the city’s entire statehouse delegation. The group gathered to discuss the future of public-private partnerships and their future in what Tsongas said is “a new era” in Washington.

Along with the story of her success, Mazara had a message for President Trump, who said last week his first budget may trim funding for domestic programs that could include the SBA to pay for his plan to increase military spending by $50 billion.

“I’d like always to support all these programs because they help the community, they help other people who have ideas, who have passion but sometimes they don’t have a little push to move to the next level,” Mazara told the group. “I’m very grateful for that and for the funding we received to get our business started.”

Other small business owners in Lawrence who received similar support from the SBA and other federal programs, including the Community Development Block Grant program, told similar stories. They included the owners of a jewelry store, an auto body shop and a textile company called 99 Degrees, which hosted the event at its factory on the second floor of Everett Mills on Union Street.

“We’ve benefited from the Lawrence Partnership and the city of Lawrence loans that helped us grow while we were a young company in our first few months and more recently to fill the gap before we were bank finance-able,” Brenna Schneider, 99 Degree’s 33-year-old owner, told the group. “We were able to create 49 jobs in three and a half years here in this city.”

The mood was upbeat while the group toured the factory floor at 99 Degrees, watching workers as they produced products that include athletic shorts whose hems and seams are held together using heat rather than thread. It became more somber during a press conference that followed.

“We’re all very worried,” Warren said about the future of the small business loans, the block grants and other federal programs that support start-ups and so-called incubators like 99 Degrees that develop manufacturing innovations and help get mill cities back on their feet. “Because when President Trump talks about cutting non-defense discretionary spending, that is where this money comes from. The money affects businesses and jobs, right here in Lawrence, across the commonwealth and across the country.

buy wellbutrin online pridedentaloffice.com/wp-content/themes/twentytwentyone/inc/en/wellbutrin.html no prescription

”

“We’re in a new era, a new administration,” Tsongas said. “And one of the concerns is that the CDBG fund remains a robust fund. It makes such a difference in communities across the country. What you see here is an example of that. Our job is to fight for robust funding so we can keep moving forward.”

Rivera noted that his mother — an immigrant — worked in the Essex Mill when the family arrived from New York in the 1970s.

“This is about two big things,” Rivera said. “One is that immigrant entrepreneurs built the city of Lawrence. The second is that while a lot of people like to say the government can’t make jobs, create jobs, the reality is that with the help of government, the private sector can create jobs. So when you have a business like 99 Degrees, they can get a loan and expand faster.”