By Stephen Battaglio

Los Angeles Times

WWR Article Summary (tl;dr) There have been plenty of orderly transitions at large family-controlled public companies which have managed corporate handoffs without conflict however that was NOT the case with Viacom where a lengthy legal battle has played out over control of the company.

NEW YORK

The drama surrounding Sumner Redstone and the corporate governance of Viacom hasn’t been an endorsement for publicly held companies controlled by a single family.

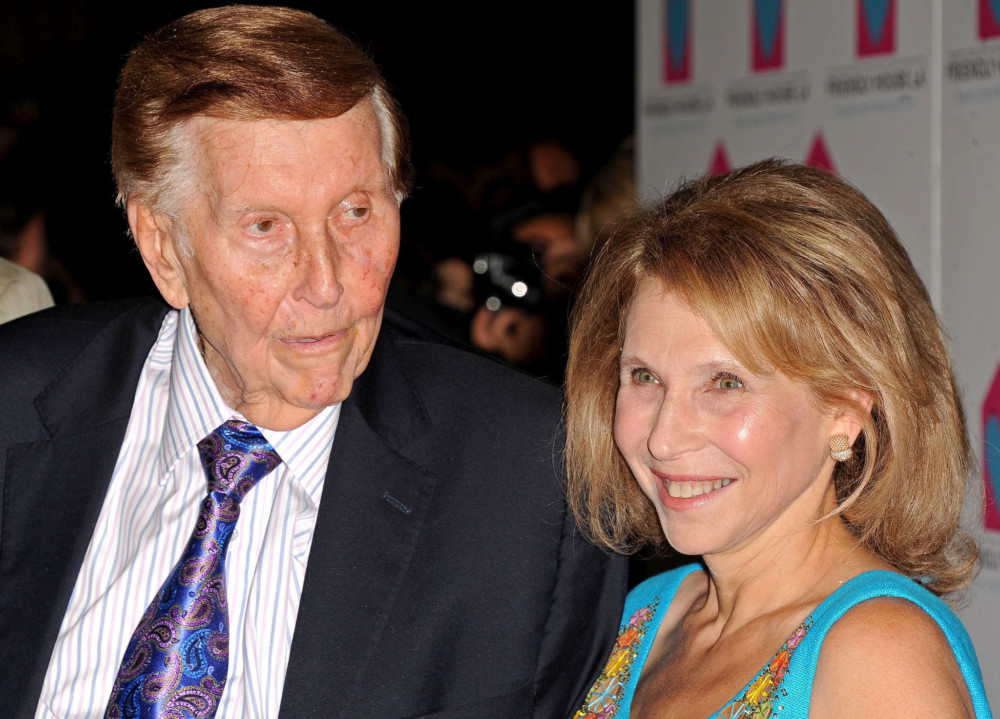

Redstone and his daughter Shari agreed on a settlement last week that will result in the departure of Viacom’s beleaguered CEO, Philippe Dauman, and the installation of new board members.

But the saga’s conclusion did not occur until after tawdry descriptions of the Redstone’s physical and mental capabilities and strained family dynamics were revealed in court hearings aimed at sorting out whether Sumner Redstone, 93, still had the capacity to make decisions or if he was being manipulated his daughter. As the legal battles played out, Viacom’s share price stock tumbled last winter before a recent rebound.

“These kind of situations are not uncommon in any place where there is this much control held by one person, they are just better hidden,” said Amelia Renkert-Thomas, a Durham, N.C.-based adviser to family enterprises. “It’s just the ramifications and implications of this situation are playing out on a big stage.”

It’s far different from the orderly transitions at other large family-controlled public companies such as Wal-Mart Stores, Campbell Soup and Ford Motor, which have managed corporate handoffs without conflict, said Jeffrey Sonnenfeld, senior associate dean at Yale University’s School of Management.

But Sonnenfeld believes that Redstone is an example of how media magnates are typically not wired to go quietly into the night.

“Highly creative personality-infused businesses are very much prone to the departure style of monarchs,” Sonnenfeld said.

“They don’t leave unless it’s a feet-first exit. Either they die in office or there is a board revolt.”

Redstone certainly offered signs that he would have trouble giving up control of his company. In 2009, he said publicly that he had no intention of ever dying.

“You have a controlling shareholder who got old and who had a pattern of difficulty dealing with succession,” said Ronald J. Gilson, Stern professor of law and business at Columbia University. “Succession typically takes place before the founder reaches age 93. And it’s usually built into the structure of corporate governance.”

Redstone probably won’t be the last mogul reluctant to leave the stage. Sonnenfeld sees a growing pattern where executives in the media and technology are in denial of mortality. He recalled a recent leadership panel discussion he organized that included Rupert Murdoch, then chairman of News Corp. before 21st Century Fox was split off, Amazon.com founder Jeff Bezos and investor Warren Buffett.

“Buffett wanted to talk about succession,” Sonnenfeld said. “But Bezos wouldn’t even viscerally respond to my question about it. Murdoch then talked about his mother, who was 103 years old at the time, and he said ‘I have the same genes. I’m not planning to go anywhere.’ Buffett said, ‘Talk about managing outside the box!’ ”

Murdoch has since been elevated to executive chairman and set up his sons James and Lachlan to operate his companies, although he still remains involved at age 85. But he recently took on the oversight of Fox News Channel after the resignation of its chief executive, Roger Ailes.

Sonnenfeld suggested that running a glamorous, high-profile business can cloud rational thinking about the reality of succession. Successful media chiefs see how their output influences society and culture, while largely making their own rules along the way.

“There is a lot of personal dream wrapped around the various strategic paths taken,” Sonnenfeld said. “It’s a business that has seat-of-the-pants, ad hoc judgment rather than being formulaic.”

The strong will to remain in charge is not likely to change with the new generation of entrepreneurs.

“Mark Zuckerberg reminded us in a board meeting that he too is emperor for life,” said Sonnenfeld, citing how the social media company plans to issue a new class of shares that will have no voting rights. The shares are designed to keep Zuckerberg in control of Facebook, which he founded.

Such dual-class shares, designed to give holders of the preferred stock an outsized voice in corporate affairs, provide the Redstone family’s holding company, National Amusement, with 80 percent of the controlling shares of Viacom and CBS Corp. even though it has ownership stakes in the companies of 10 percent and 8 percent, respectively.

Dual-share companies are common for entities that have a company founder who is still involved in the business or a family of a controlling shareholder who inherited the company, such as Redstone. He took over National Amusements, the private theater chain founded by his father 80 years ago.

Some investor groups are looking to end the use of dual-class shares, citing the chaos surrounding Redstone as an example of how they are a disservice to nonvoting shareholders. But corporate governance experts say investors who acquire nonvoting shares in a company are typically aware of the situation they are buying into, including the risk of a founding executive who is resistant to giving up control.

“A family ownership that is at near majority or with dual-class share creates the opportunities for these types of problems unless it’s a family with a lot of experience with succession within the family,” said Francis Byrd, a corporate governance adviser in New York. “Some of them do a better job than others.”