By Morgan Chilson

The Topeka Capital-Journal, Kan.

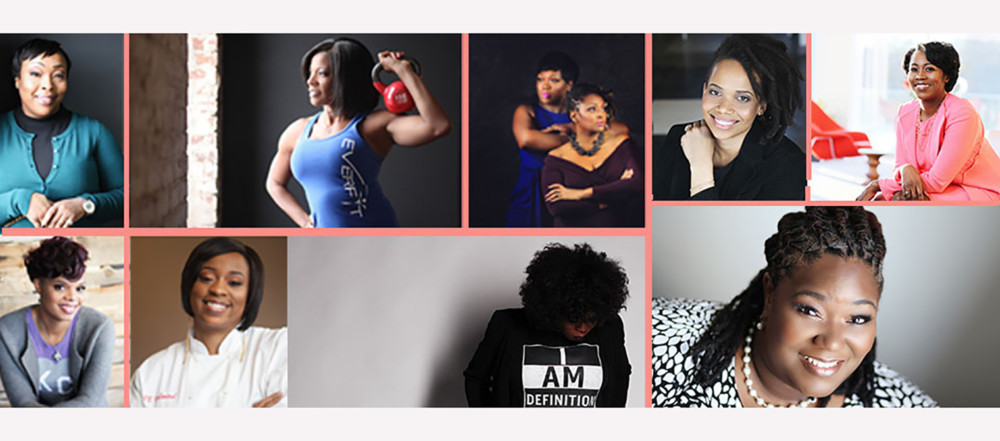

WWR Article Summary (tl;dr) The report explores the challenges, motivations and needs of 34 black women entrepreneurs.

The Topeka Capital-Journal, Kan.

Black women started 1 million businesses between 2002 and 2012, showing a growth rate in entrepreneurship unmatched by any other group. But few talk about the potential in that data, a regional expert said Wednesday.

A new report from the Federal Reserve Bank of Kansas City is drawing national attention after it pointed to the 179 percent increase in the number of businesses owned by black women and showed the potential economic impact should those businesses receive the support they need to excel, said Dell Gines, senior community development adviser of the bank’s Omaha branch.

Gines was in Topeka to talk about the real numbers behind businesses owned by black women and what communities can do to support them.

The report, available online at kansascityfed.org, delved not only into the numbers but into the psyche of black women entrepreneurs, he said. It can be used for communities wanting to create programming to support this segment of business growth.

“The first stage is awareness, then it’s acknowledgement, then it’s activation,” Gines said. “The reality is people just don’t know. I’ve known about this trend for a long time. Why is no one really talking about this?”

The report, he said, explored the challenges, motivations and needs of 34 black women entrepreneurs.

“For folks that want to develop programming to accelerate economic growth, reduce poverty gap, decrease wealth gap, it gives you really a blueprint of what your general black woman entrepreneur is,” he said.

Phelica Glass, a licensed clinical social worker in private practice, was inspired to hear the data.

“Black women are actually building businesses at a large rate that the community does not talk about,” she said. “To be a part of the number is phenomenal, but I also love the idea to talk about how do we support black businesses that are owned by women or minorities in general, so that they can become large-scale. We’re groomed to grow up and work for someone else, and make someone else a millionaire. We’re never taught that we can be that millionaire.”

The data on businesses owned by black women shows many don’t have employees, work part-time in their business and have average annual sales of $28,000, significantly lower than the average $140,000 for all women-owned businesses, Gines said. Many of those businesses don’t convert over time to employer businesses, meaning they are just one person with no employees.

Low sales may be part of the reason communities and economic developers don’t focus on this segment of the entrepreneur population, Gines said. But he contended those businesses run by black women have the power to change communities through two factors: being located in concentrated areas and intergenerational impacts. There are still large pockets of black people who live near each other, he said.

“At the city level or the national level, the impact probably isn’t that great,” Gines said. “But when I put them all in the same community and it’s concentrated, and the funding is impacting household income, paying for their kids’ diapers, putting money into their local economy, that impact grows tremendously within the context of their community.”

The second factor is based on data showing children of entrepreneurs are more likely to become entrepreneurs. Consider the 1 million women who started businesses between 2002 and 2012, he said.

“Now the questions will become with their children, are we going to allow them to have such a starved environment as we allowed their mothers?” Gines asked. “Or are we going to figure it out and know how to do development and programming better so that we can capture this oncoming wave of black children who are going to be business owners because they saw their mom, and do better for them than we did for their mom?”

Gines encouraged the Topeka community to take a critical look at its ecosystem and see where it is supporting or hindering black women building businesses.

“We have to say, are our systems reinforcing some of the inequities in the outcomes that we want to have?” he said.

Women in the KC Federal Reserve study pointed to a need for more mentoring, more peer-to-peer support and more learning opportunities about business, among other things.

For local artist Oshara Meesha, more support would be helpful.

“I hold myself back too much,” she said. “Just not putting myself out there, or just not showing what I do have the ability to do. When I’m around people that have overcome or are in the process of overcoming, then that is encouragement to me.”