By Susan Tompor

Detroit Free Press

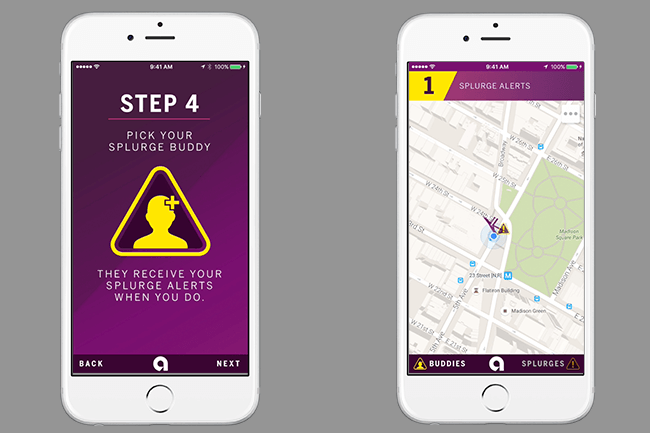

WWR Article Summary (tl;dr) When it comes to women and money, we all know how good it feels to pick up a little extra something like a new blouse or funky piece of jewelry when we are feeling down. But those extra unplanned purchases can add up. Ally bank hopes its new app called “Splurge Alert” may help you stop and reconsider that spending? It works like this: You identify trouble spots like the stores and restaurants where you know you burn cash or pull out plastic a little too much. The app uses geolocation technology to alert you that you’re approaching a “splurge zone.” Oh by the way, a “buddy” of your choice gets the alert too…so forget about sneaking that purchase, you’ll be called out.

Detroit Free Press

Who, honestly, doesn’t splurge sometimes? Perhaps even a few times during a week?

A friend of mine dubbed these impromptu expenses the $100-pick-me-ups. You know, you work hard to juggle duties and deadlines. And then, you figure, “Hey, I deserve this really great fill-in-the-blank.”

The treat could be a bottle of red wine, some Under Armour running gear or a cool hammock from the Finnish Marimekko collection at Target. It doesn’t matter. It all costs some money, even if you really deserve it.

But what if somebody could stop you or at least ping you and say, “Hey, do you really want to buy that now?” Well, Ally Financial is putting that idea to the test with the beta release of a new app called Splurge Alert.

It works like this: You identify trouble spots like the stores and restaurants where you know you burn cash or pull out plastic a little too much. The app uses geolocation technology to alert you that you’re approaching a “splurge zone.” (I know, when was the last time you didn’t realize you were heading straight into a DSW shoe store and clutching a coupon?)

Even more important, a friend or family member gets a push notification when you walk into that DSW or Starbucks or Lowe’s.

Yes, you pick a “buddy,” someone who might be able to talk you out of spending more money.

“It helps you because it makes you stop and think,” said Andrea Riley, chief marking officer for Ally Financial in Detroit.

Consumers can sign up to test that app, which could be ready for prime time by June.

Riley said the app isn’t meant to chastise people or shame them into putting their wallets away. But it’s a nudge to make you think again about whether a purchase is really worthwhile.

About 85 percent of Americans admit to splurging, according to a survey commissioned by Ally and conducted online by Harris Poll.

And splurging can be problematic.

What if another box of shoes is standing in your way of building up savings for a down payment on a car or house? Ally says shopping can turn into the enemy of saving.

“It’s time to turn around and walk away from spending that money,” Riley said.

Trina Hardville, 37, of suburban Detroit, said the Splurge Alert app sounds like the opposite of shopping apps such as RetailMeNot, which encourage you to take advantage of deals.

Another app, Shopkick, actually rewards you with points for future discounts for walking into stores. The app brags that it can make sure that you “never miss deals and exclusive rewards at your favorite stores.”

Hardville sees the advantage of a Splurge Alert app.

“I’m an impulse shopper,” Hardville said, noting that it’s not unusual for her to spend $75 at Target even if she’s only stopping in to buy toothpaste.

Traci Romo, 45, her co-worker at AAA Detroit, said she loves apps and might use one to control her spending for trips to DSW or Carter’s children’s clothing stores.

“You’re almost putting, like, a tether on yourself,” Romo said.

Still, she quickly admits that she’d probably deactivate any app if she really planned to splurge big.

Sonya Robinson, 39, joked that the idea of a buddy for a Splurge Alert sounds like picking a sponsor for a 12-step addiction program.

Even so, she might select her teen daughter as a buddy to warn her when she was about to spend too much at a spot like J.C. Penney.

“She’s 17 and she would give that sarcastic, ‘You’re there again,'” Robinson said.

“My goal right now is to save $1,300,” Robinson said.

To do that, she’s been automatically transferring $25 a month from her paycheck into an account to tap into for expenses associated with celebrating her daughter’s high school graduation this year.

She’s been trying to cut back on smoothies that cost nearly $4 a pop, clothing and fast food. She signed up for Mint.com to monitor her budget, but she has had limited success with that tool, she said.

“I haven’t checked it since I installed it,” said Robinson, who works as a project planner for the Detroit Metro Convention & Visitors Bureau.

Ally is enlisting the help of some big names, including HGTV’s Property Brothers co-host Drew Scott, and country music duo, Big & Rich, to help test Splurge Alert and reveal how they spend their money.

Scott said he realizes that big and small purchases can throw people off track from their goals.

“It can be little everyday things that get in the way. Like for me, I have a weakness for smoothies and sushi, which can really add up,” Scott said in an emailed statement.

“My brother and I see homeowners splurge all the time when renovating a home. A little is OK, but it is always best to have a plan.”

Could an app help you stop and reconsider that spending? Maybe. But you’d have to be willing to download it first and you’d have to pick that right buddy.

Shaun Sturdavant, 21, said he’d pick his friend who shops at the same places he does for men’s clothing, like Express and American Eagle.

“He’s got my back and I’ve got his,” said Sturdavant.

What you don’t want is the control freak in the family to force you to download that app so they could track how often you’re popping in for coffee or shoes or playing golf.

No one wants a Splurge Alert to turn into a NagYouNow app.