By Jon Chavez

The Blade, Toledo, Ohio.

At some point nearly every small business needs a loan to grow, but securing a loan can be daunting for those who don’t know how to go about it.

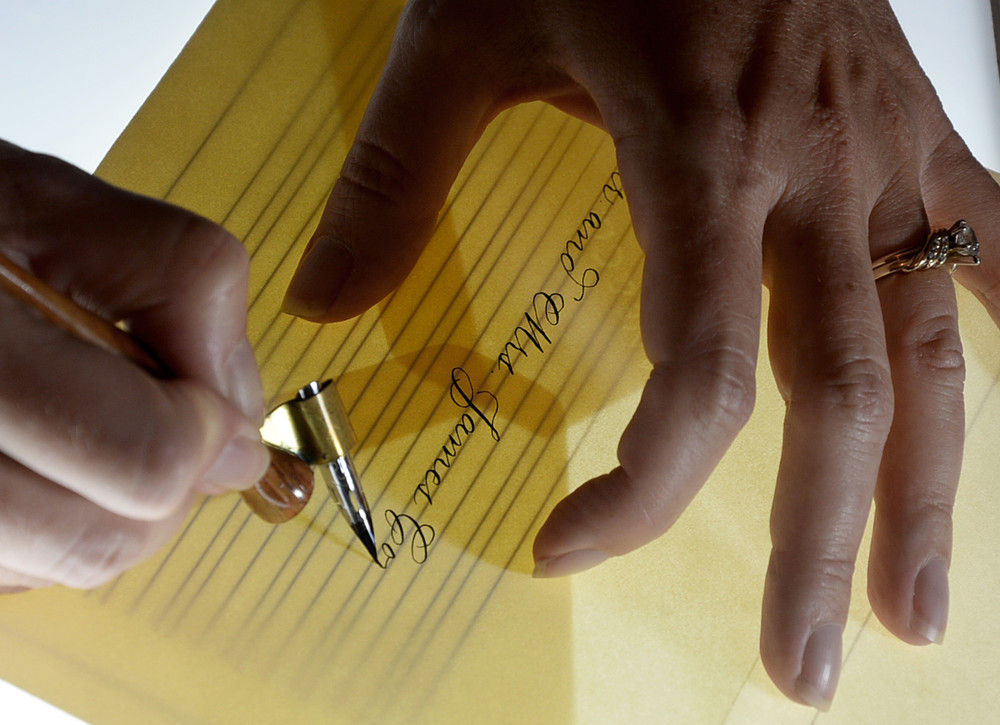

“The most important thing you can do is develop a business plan,” said Gil Goldberg, director of the Cleveland district office of the U.S. Small Business Administration.

Writing a business plan, getting loans, finding help, and other key issues were part of a two-hour seminar Monday at the University of Toledo business school.

The seminar, presented by the SBA and co-sponsored by U.S. Rep. Marcy Kaptur (D., Toledo), featured panel discussions on technical assistance and lending practices, as well as comments from various small business experts.

About 60 people attended the event with small business owners or entrepreneurs making up nearly two-thirds of the attendance.

The event kicked off the celebration of Small Business Week, and Mr. Goldberg said the seminar idea came from Miss Kaptur, who was seeking ways to provide help to northwest Ohio’s small business owners.

“I came from a small business family, and I know how hard it was,” Miss Kaptur said in opening remarks.

A key speaker at the event was Mo Dari, president and CEO of Toledo-based The Oasis Restaurant & Delivery, who received the 2015 SBA Cleveland District Entrepreneurial Success Award.

Mr. Dari, who began as a pizza franchise owner in 2001, sold his pizza business in order to begin his food carryout business in 2008 at the start of the recession. Oasis was a struggle at first, and Mr. Dari said at one point he needed to restructure his SBA-backed loan in order to avoid filing for bankruptcy.

“I was ready to call it quits,” he said.

But his lender, Bank of Maumee, “stood by me and said, ‘What do you need?’ ” Mr. Dari said.

He is now working on getting his fifth SBA-backed loan, and Oasis, which once looked doomed, now has $10 million sales and employs 350 people, he added.

Mr. Dari said that as a small business owner he has learned several things, the most important of which is you have to keep growing your business.

“The minute you’re not growing, you’re dying,” he said.

Donald Hill, a small-business owner and president of Brickyard Sloppy Joe Sauce, said having a business plan is huge for an entrepreneur because it provides a blueprint to follow.

“When I started, I knew what I had, I just didn’t know how to bring it all together,” he said.

The banking panel gave the small business owners sanguine advice about how and, more importantly, when to seek a loan, and what bankers will expect.

“When you do go to the bank, if you’re not prepared, it could set you back,” said Steve Wizgird, a small business loan expert at KeyBank. “If you’re not prepared, the lender might lose interest in you, so going to a bank too soon can be a major issue.”

Rick Heltzel, chief credit officer at Bank of Maumee, said many small business owners go to a bank seeking a loan, but that may not actually be what they need.

After an examination, the loan officer might deny an owner a loan but find another way to help, such as by reprioritizing business payment schedules.

“Don’t be discouraged with your first conversation with a banker,” he said. “You may find what you need is to lay out a different path.”

One small business owner explained how she had a good business plan and good credit but could not show equity invested in her business. How, she wondered, can someone who doesn’t have money for a startup get money without getting a loan?

The panel experts said a new helpful route not previously available is crowd funding via Internet sites such as Kickstarter.com or Indiegogo.com.

Two seminar attendees, Jacob Bauman and Chris Eischen, who own a new startup, Cultivated Marketing, explained how they recently used an Indiegogo crowd-funding campaign to raise more than $700,000 for a client who makes a charging device called ThingCharger.

Cultivated Marketing, Mr. Bauman said, eschews traditional marketing, such as print and TV, in favor of social media marketing on Facebook, Twitter, and Pinterest.

“What we do is give small businesses without a large budget the chance to get their product out there. Social media is where things are headed, and we specialize in that,” he said.