OPINION

Chicago Tribune

WWR Article Summary (tl;dr) Editorial out of the Chicago Tribune about what went wrong with “Theranos”, the once heralded silicon valley startup which was set to revolutionize the way blood tests were performed.

Chicago Tribune

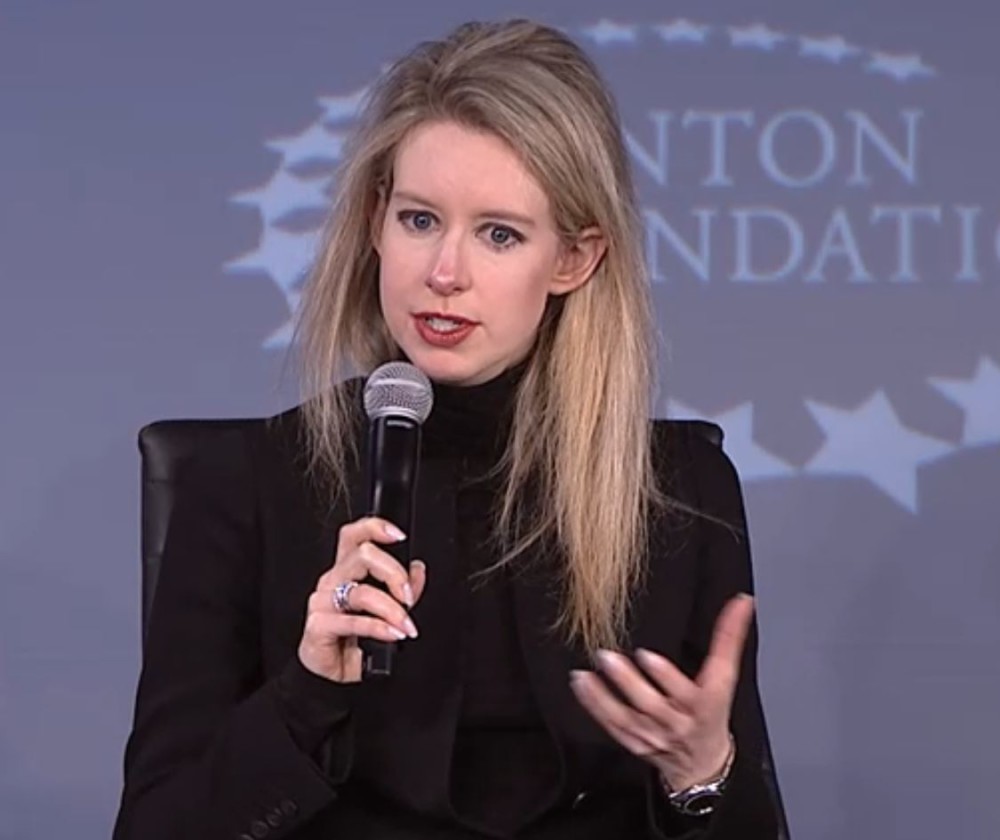

Elizabeth Holmes’ big idea was a smart medical device that could perform many sophisticated blood tests from just a finger prick. This would be a small miracle for patients who hate needles.

In the Silicon Valley fairy-tale version of her career, Holmes and her company, Theranos, would make billions by making life easier for millions. Walgreens bought into the idea, investing $50 million. The plan was to dispense Theranos blood tests at thousands of Walgreens drugstores, providing customers with a cheap, effective alternative to doctor’s office visits, and those scary needles.

Another cool new technology to change the world, right?

Well, not exactly. Belief in innovation was so ingrained among business leaders and consumers, and Holmes’ salesmanship so persuasive, that investors poured more than $400 million into Theranos … and missed the warning signs.

The company made bold claims but kept its technology secret. When Walgreens executives visited, they were not permitted into a lab to examine data. Yet the drugstore chain forged ahead, concerned that a competitor would rush in and strike a deal, according to The Wall Street Journal.

Others were equally smitten, comparing Holmes, a Stanford dropout, to Steve Jobs. Forbes estimated Theranos’ value at $9 billion, which made Holmes with her 50 percent stake theoretically worth $4.5 billion. This was despite the absence of scientific studies confirming her device works, and the fact that company sales never topped $100 million.

Here’s how the Theranos system was supposed to work: A few drops of blood drawn from a finger stick would be delivered to a nearby Theranos lab, where the company’s proprietary machine, known as Edison, would analyze the sample and spit out results.

Lots of tests (cholesterol, glucose, etc.) were available, at prices significantly below what traditional labs charge. Last year, Theranos told Tech Insider that Edison could perform more than 70 tests from a single tiny sample of blood.

The bottom fell out after the Journal reported that the company overstated the abilities of its machine. Theranos, operating about 40 centers, mostly in Walgreens stores in Arizona, did most of its blood tests using conventional lab machines, not Edison, the Journal said. Some former employees doubted the accuracy of Theranos’ lab results. A small-scale study of the company’s technology published in a medical journal this year found the machine’s blood test results were less reliable than conventional methods.

On Sunday, Walgreens killed its deal with Theranos and will close the blood testing company’s clinics in Walgreens drugstores.

One of Walgreens’ chief concerns: Theranos recently voided tens of thousands of patient blood tests, according to the Journal, raising serious new questions about the company’s competence.

Theranos has fought back, seeking to discredit critics. But without corroboration from independent experts, it’s impossible to assess the company’s technology, or its prospects. There’s a reason the $75 billion diagnostic lab industry requires vials of blood from patients, not droplets: because no one figured out a better way.

Federal prosecutors are conducting a criminal investigation of Theranos while the Securities and Exchange Commission is looking at whether Theranos misled investors. The company also had operational lapses in one of its labs, leading the Centers for Medicare and Medicaid Services to consider banning Holmes from the blood-testing industry for two years.

All that constitutes serious legal trouble. In terms of Silicon Valley credibility, the defining blow to Theranos came from Forbes: The magazine stripped the company of its high-flying valuation. Theranos is not worth $9 billion, Forbes said recently, it’s probably worth just $800 million. And Holmes, who previously topped the magazine’s list of America’s richest self-made women, now has a net worth of … nothing. It’s all a guess by Forbes, given Theranos’ private ownership structure, but the magazine assumes if Theranos were to liquidate there would be nothing left for Holmes after other investors retrieved their cuts.

It’s still theoretically possible Theranos cracked the code on blood tests and will recover.

What’s certain is the company made aggressive boasts that went unchallenged by investors who were so dazzled by a potential innovation they never demanded an answer to the basic question: Does this thing really work?