The Seattle Times Sunday Buzz column

The Seattle Times.

When Phyliss Heppenstall in the 1980s pioneered the concept of a soft-core sex shop welcoming to women, it was “a natural progression” in building a family business, she says: first selling at home parties, then opening retail shops in Auburn, Burien and Renton, and over time creating a West Coast chain of more than 30 stores.

But these days even a sex store can be subject to heavily leveraged financial engineering and get-big-fast fantasies.

Peekay Boutiques — best described as a blend of Victoria’s Secret, Toys R US and Ace Hardware — is now an Auburn-based public company. Heppenstall and her three adult children sold it in late 2012 to investors who paid with borrowed money, and the new owners on Dec. 31 folded it into an asset-less shell company.

The business that emerged looks like it could have some trouble between the sheets — the balance sheets, that is.

The new Peekay has more than $52 million in debt, largely from buying Heppenstall’s chain and a smaller one based in Texas. Due next December are high-interest loans totaling $38 million.

On the other side of the equation, Peekay has less than $9 million in cash or tangible assets — a situation lenders and investors may not find very sexy.

The operation’s new CEO, Lisa Berman, says it is poised to be “a leader in changing the perception of sexual wellness” with 46 stores, including 20 in Washington under the Lovers brand.

Peekay shops, staffed mostly by women, are designed to be “more Sephora-like, [rather] than a dark and dingy place,” Berman says. “Our target base is the Nordstrom-Macy’s customer.”

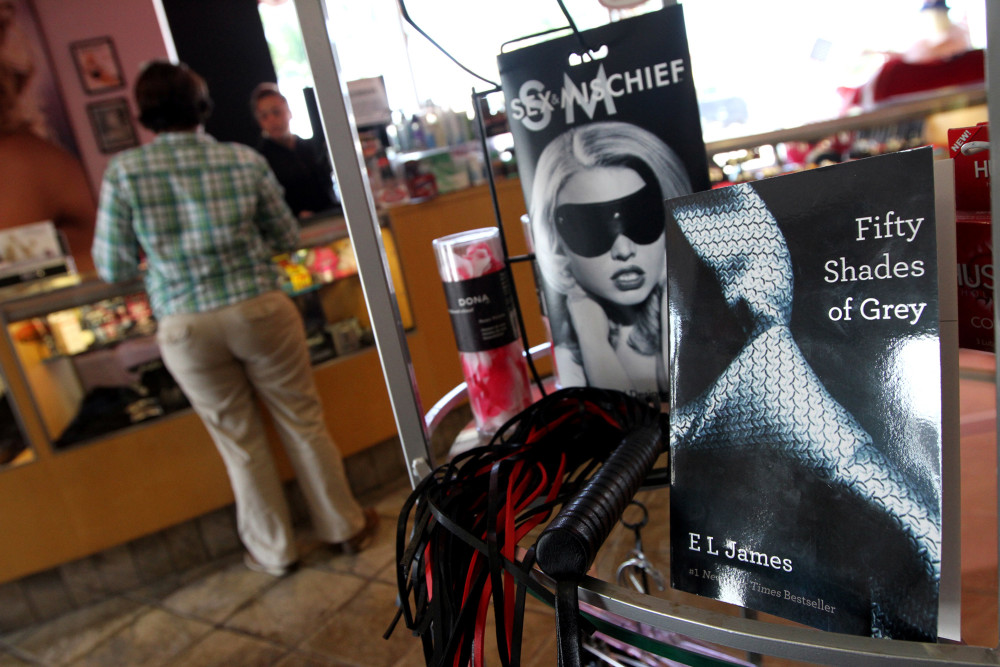

The company is trumpeting Valentine’s Day and the release of the “50 Shades of Grey” movie as its opportunity to emerge from behind the curtain and flash its wares to an increasingly accepting public.

Oprah and Barbara Walters have talked about sex toys on the air, says Berman, a San Francisco-based retail veteran who most recently ran a company called jimmyjane, which, she says, “innovated and designed high-end vibrators.”

While mainstream retailers like Target, CVS and even Wal-Mart “all carry some of these products in their stores — condoms, lubricants, small vibrators,” says Berman, there’s still an important role for a specialty store: “Nobody is going to go to Target and ask for advice on how to use those items.”

Her staff, by contrast, are “great educators” and “can make customers comfortable,” Berman says. The company’s vision of itself comes through clearly in a promotional video that shows a smiling young woman shopping in a colorful store; the sound track is a lilting, whimsical Kat Edmonson tune also featured in an Apple iPhone commercial.

Peekay hopes to add eight to 15 stores a year and make more acquisitions. But it may have a hard time finding the cash to do anything as dramatic as buying Heppenstall’s chain, which regulatory filings indicate cost about $37 million.

If consumers are increasingly hot for sex toys, Peekay’s financials don’t really show that: Sales were $29.4million for the nine months ended September 2014, virtually flat with the year-earlier period.

Operating income was $2.2 million, down from $3million — but after Peekay paid more than $4.9million in interest for each 9-month period, the bottom line was negative. Its financial performance has repeatedly missed financial targets agreed upon with the lenders.

While Peekay is listed in the over-the-counter market as PKAY, the stock hasn’t actually traded yet; its shares are held by just a handful of investors.

The financial engineer behind the deals is Ellery Roberts, a Texas private-equity guy who last fall also tried to buy the Calphalon retail outlets but didn’t complete the deal. When Peekay borrowed $50 million, the investors led by Roberts, in true private equity style, paid themselves $5 million of that.

Asked about the high level of debt and the December deadline for repaying $38 million, Roberts suggested Peekay expects to raise capital by selling stock to private investors or the public.

“As we begin to take advantage of our new status as a public company,” he added in an emailed statement, “we believe that our financial condition will be enhanced and that we will be able to execute our business plan even though our current balance sheet is relatively highly leveraged.”

Heppenstall, who says she has some stock in the new company, seems comfortable with those plans.