By Walter Hamilton

Los Angeles Times.

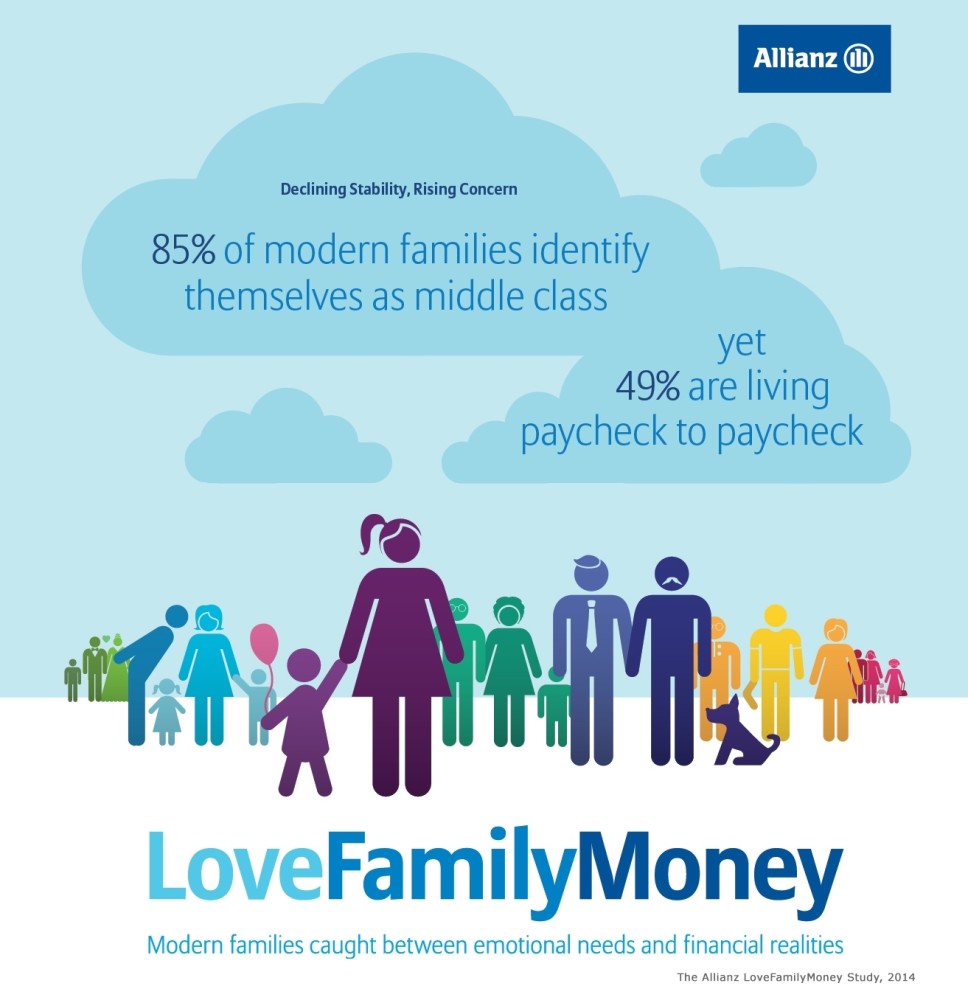

Nontraditional families, such as those headed by single parents or same-sex couples, are in far worse financial shape than conventional households headed by married heterosexuals with children, according to a new study.

Nontraditional families fare much worse across a variety of measures, including their ability to save money for emergencies and their own sense of economic well-being, according to the survey by insurance company Allianz.

Nearly half of so-called modern families, for example, live paycheck to paycheck. That compares with 41 percent of conventional households, according to the survey.

Only three in 10 nontraditional households have a high degree of confidence in their financial well-being versus 41 percent for their conventional counterparts.

buy aurogra online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/aurogra.html no prescription

The financial woes of modern families are a big issue given the growth of nontraditional structures in recent decades. Only 19.6 percent of U.S. households are composed of married heterosexual couples with children, down from the 40.3 percent in 1970, according to Allianz.

Aside from same-sex couples and single-parent homes, Alllianz defined nontraditional families as those with three or more generations living under one roof; blended families in which at least one parent has a child from a prior relationship; older parents with young children; or parents whose adult children live with them.

“New family structures have a direct impact on a family’s relationship with money and finances, and we found that, while modern families have similar strong emotional ties, they often feel financially less secure than their traditional counterparts,” said Katie Libbe, an expert on consumer insights at Allianz.