By Hanah Cho

The Dallas Morning News.

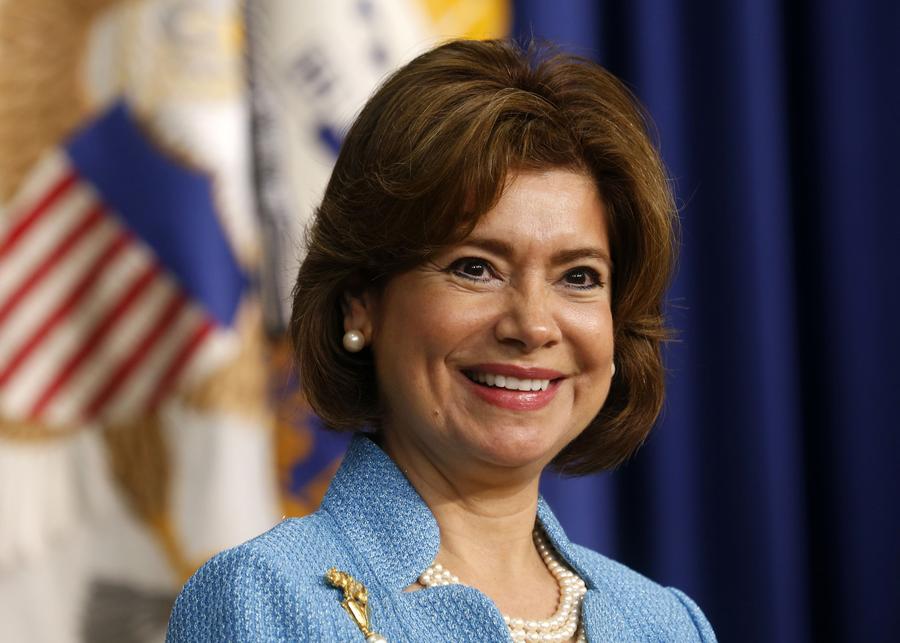

SBA Administrator Maria Contreras-Sweet has a new interpretation of the acronym for the federal agency tasked with supporting U.S. small businesses: Smart, Bold and Accessible.

Contreras-Sweet was sworn in as the new head of the Small Business Administration in April. The former banker has made it a priority to modernize the agency and make resources such as access to capital more obtainable for entrepreneurs.

“What we’re trying to do at the SBA is help America preserve the middle class and social mobility,” Contreras-Sweet said.

Contreras-Sweet visited the Dallas region recently to meet with local SBA employees as well as small businesses in the area.

She gave the keynote speech at the America’s Small Business Development Center Network’s national conference in Grapevine last week. Contreras-Sweet spoke with The Dallas Morning News about the lending environment, her priorities and challenges facing small business owners.

Here’s an edited excerpt:

Question: What are the biggest challenges facing entrepreneurs and small businesses?

A: What’s taking place is that technology is changing the way we think about entrepreneurs. That’s why the [Small Business Development] counseling centers become invaluable, because we have to consider the way the technology changes the way we do business.

We have to think about the way we keep business nimble and responsive to the way consumers think about things: how they position themselves and how they deliver their products.

Question: Then what is the role of the SBA?

A: I reframed the SBA’s work. I call the SBA smart, bold and accessible, and so the new frame for the agency is the modernization that you and I just outlined.

It’s important for the SBA to understand the technological evolution. It’s about relearning. And how do we work with our strategic partners. And how do we counsel the small business.

One of the things we’ve done under the smart initiative is some of the underwriting that was stuck in the past has changed. For example, the nine-month rule: If you didn’t make your loan in nine months, you had to start over. What is magic about nine months? Let’s throw that rule out.

With technology, we put in a total smart score and made it available for community banks who don’t have wherewithal to put together a system like the large banks. It’s a predictive score and reduces paperwork.

Around our bold initiative, if you’re a small business and you get a contract with the federal government, you get paid in 15 days. That’s huge. We’re inviting corporations to match us.

Question: As a former bank executive, how would you characterize the current lending environment for small businesses?

A: In every lending category, our lending is up. We went to Congress this week to extend our limit because the bankers are doing such a nice job. African-American lending is up 107 percent.

In many of these fields, the numbers have gone up because the economy is getting stronger, small businesses have more confidence and the bankers are doing a very nice job with the tools we’ve given them.

Question: What is the SBA doing to facilitate access to smaller loans?

A: When you’re coming out of the recession we just had, people want to start a business. They don’t need $7 million right away. They want to start with small dollars.

One [program] is our Community Advantage loans. We’ve zeroed out the fees on this loan. And we’re reaching out and expanding the micro lending network.