By Hanah Cho

The Dallas Morning News.

How do you protect your business from potential legal issues or conflicts? Jeff Bell offers tips on documents every entrepreneur needs.

Bell is CEO of Dallas-based LegalShield, which provides legal services.

Form a limited liability business entity

Businesses face internal and external risks. Without a formal business entity filed with the Texas secretary of state’s office, a business owner’s personal assets could be at risk. Limited liability companies are easy and inexpensive to form in most states and provide you the needed protection.

Get your bylaws on paper

Many business owners do not appreciate the need for written bylaws or operating agreements and current minute books. Even if you don’t have a formal business entity and you have a business partner, you need a written agreement. These are nonpublic documents that reflect the agreement among the owners concerning the business purpose, conduct, affairs and the relationship among the owners. If you ever apply for a loan, you’ll be asked for a copy of this document.

Power of attorney

Who is going to run your personal business if you can’t for health or other reasons? Don’t wait for calamity to strike and lose what you worked so hard to build. Get a plan in place and a formal power of attorney signed to prevent any business disruption.

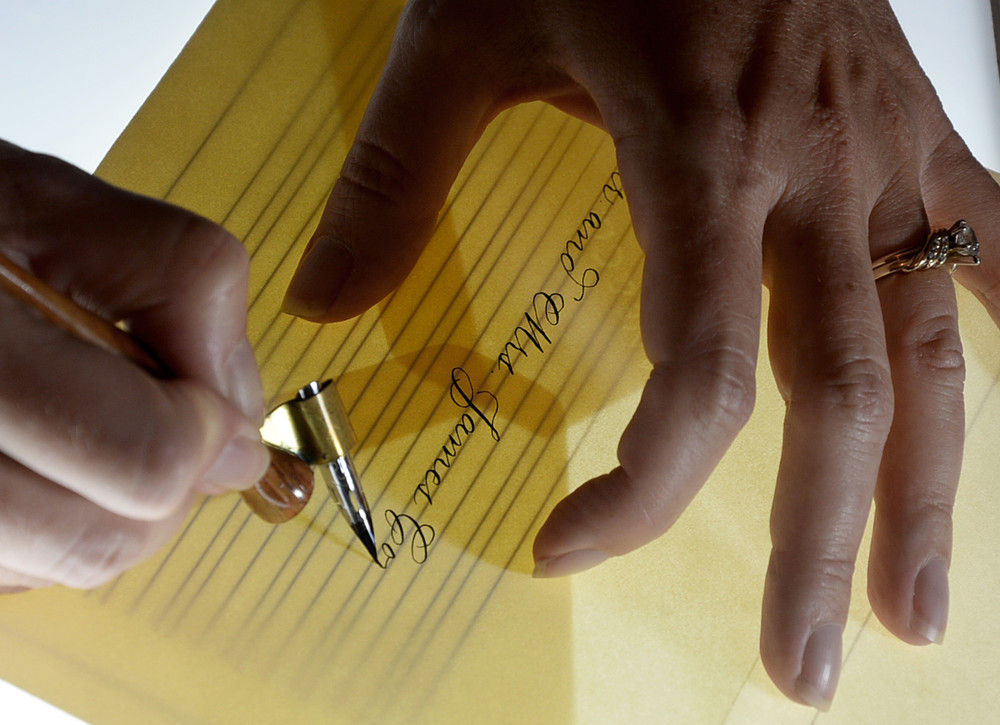

Solid customer contracts

No business owner wants to fight with a customer, but it happens. Solid contracts can help avoid disputes and resolve them when they happen. Contracts must be in writing. Use plain language and keep it simple. Ensure all persons are completely and accurately listed on the agreement; incorporate your payment policy and outline your responsibilities and your customer’s responsibilities; clearly state remedies for nonpayment; and above all make sure everyone signs the contract.

Insurance policy

Every business, even if home-based, needs to have insurance. Some insurance is required by law. Other types are simply prudent to protect your business. Depending on the type of business, options include property insurance, commercial auto insurance and worker’s compensation.