By Idan Rabi

Globes, Tel Aviv, Israel.

Technology has transformed almost every aspect in the life of the average Western citizen, but one industry stands out as not having experienced the Big Bang: banking.

Switzerland comes to mind immediately when we talk of banks. For historical reasons, and thanks to dedication to banking secrecy, Switzerland became a significant player in finance out of all proportion to its size or population. Recent years have also seen the emergence of a small but ambitious high-tech scene in Switzerland.

Centralway Numbrs, a Swiss start up with a connection to Israel, is in fintech. It dreams of becoming the Uber of finance, or the world’s largest bank without even being a bank.

How?

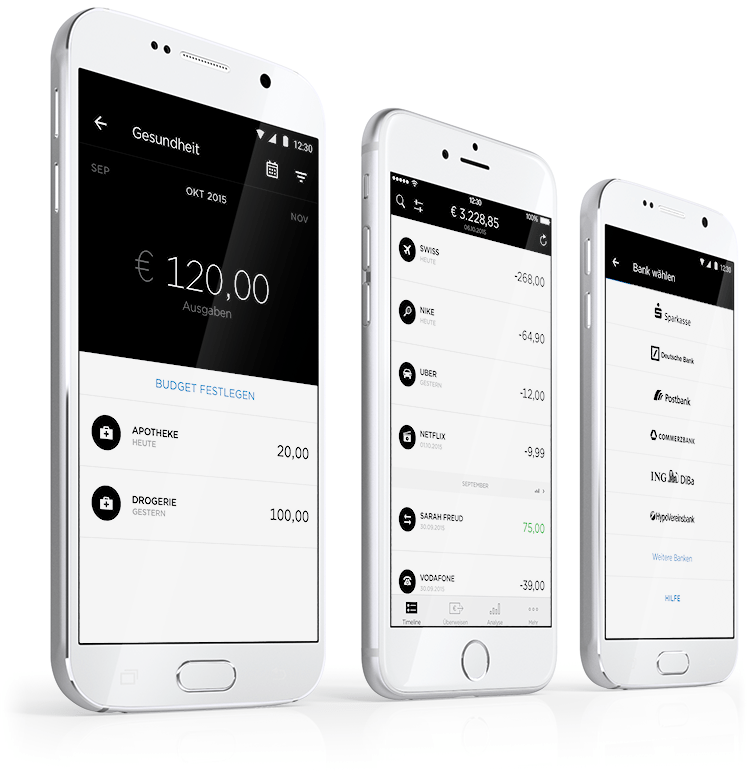

The company has developed an app that “rides” on the apps of all other banks, offering a friendly interface that analyses expenses and income and lets the users run their current and investment accounts better. People with a single bank account can benefit from the app of course, but people with two or more accounts, even if they are in different banks, benefit even more, and will be able to do so using a single app.

Since the app can be downloaded for free, Centralway has no revenue yet but its access to financial information of millions of people may prove its worth. The company prefers not to elaborate on its business model at this stage, but it can be safely assumed that the app will also allow comparison of the prices of financial products in the future.

Need a loan? The app will analyze your financial history and let you post a “bid” to different bank to get the best offer.

This competition will then branch out to deposits, investments, and so forth.

Centralway is headquartered in Zurich but its app is only available in Germany for the time being. There are 82 million reasons for this the number of people in neighboring Germany. The strict regulation of the German banking industry is another consideration in Centralway’s strategy. If we make it there, goes the rationale of the company, we will be able to compete effectively in other markets too.

The Swiss company is run by Martin Saidler, who benefits from the close support of Dr. Boaz Barak, an Israeli who served in executive positions in UBS and Credit Suisse, two of the largest and most important banks in Switzerland and the world. A serial entrepreneur for nearly two decades, Saidler says, “90% of the companies I founded are still in existence. I enjoyed taking these small companies startups that work mainly in Eastern and Central Europe and seeing them grow. But this is history. In the past few years, the Digerati Fund, which manages the investments of some of the richest families in Europe, mine included, has invested in Centralway Numbrs.”

Saidler adds, “The company focuses on retail banking and this is the reason we are active in Israel. We are looking for Israeli startup to support our attempt to build a mobile banking platform. We want to invest in, maybe even acquire, Israeli companies and are planning to open a development center here shortly.”

During his visits to Israel, Saidler has met former president Shimon Peres (“extraordinary personality — he understand how the world really works”), Prof. Eugene Kandel, and local VC professionals, including Pinchas Buchris and Chemi Peres. His first visit to Israel took place a year ago and he was very enthusiastic. “Boaz Barak told me Israel was the start-up nation, and to be honest, I had no idea about what was happening here. I read the book “Start-up Nation” and met with wonderful companies such as Check Point and MobilEye, but I never saw all this with my own eyes.”

Saidler’s first investment in Israel was in the Elevator accelerator. “I know there are many accelerators in Israel,” he says, “but we love being part of Elevator’s board.

buy ventolin generic https://rxxbuynoprescriptiononline.com/ventolin.html over the counter

They have a talented team and an unusual portfolio. They help companies accelerate to the next phase. We also invested directly in startup Moburst.”

Why Israel and not Silicon Valley?

“Israel is the right place to be. With Boaz’s help, we’re trying to build a bridge between Israel and Zurich. This relationship will be based on investing in companies and opening a development center. During a visit here, I went to the Weizmann Institute (Boaz Barak is member of the global board of governors of the Weizmann Institute). It felt like a visit to Stanford, although I have never actually been there (laughing). I saw the photos and they look alike.”

Saidler and Barak also met with representatives of the major players in the local banking industry Bank Hapoalim, Bank Leumi, Israel Discount Bank and First International Bank. “In a sense, they are following the same path as we are. They understood this is the global trend.”

One interesting niche in which fintech can grow is among people with no bank account. The economy of the Third World, with an emphasis on Africa, is expected to undergo a dramatic transformation as a result of the growing use of smartphones. “People without a bank account will use prepaid services,” Saidler explains. “They will pay in advance and then will be able to perform transactions with their money with the help of the app. We will do that in Africa and in some parts of Asia. We want to become the world’s largest banking platform.”

It sounds as though you are going to need a lot of money to make progress. Are you considering an IPO?

Saidler: “We will certainly consider an IPO towards 2017. We will give you an exclusive interview when this happens.”

A vote of confidence from Ronald Cohen

A month ago, Centralway announced a new investor Sir Ronald Cohen, founder of the Apax Fund. Dr. Barak introduced the company to Sir Ronald, who is considered one of the most successful private equity investors of all time. In recent years, Cohen, who resides in Israel and the UK, has been involved in social investments that seek to give to the community while obtaining a return. During his tenure as the chairman of APA, the fund invested in Bezeq and Tnuva. In 2013, Globes reported that Cohen seeks to found “a social investment bank” to help the third sector, but this idea has not matured.

Commenting on his investment in Centralway, Sir Ronald said, “I chose to invest in this project because of the immense social impact it would have driving down the cost of financial activity. The company is using a technology that allows it to achieve this edge quickly and globally. Using the digital banking system will enable the clients of all the banks to fulfil their personal financial dreams at the lowest cost possible. This is our calling, and a basic right of every client.”