Mary Ellen Podmolik

Chicago Tribune

WWR Article (tl:dr) From bill paying to erasing debt to buying stocks, economists take a look at what people are likely to spend their stimulus checks on.

Chicago

The first coronavirus relief checks were for $1,200. The second ones $600.

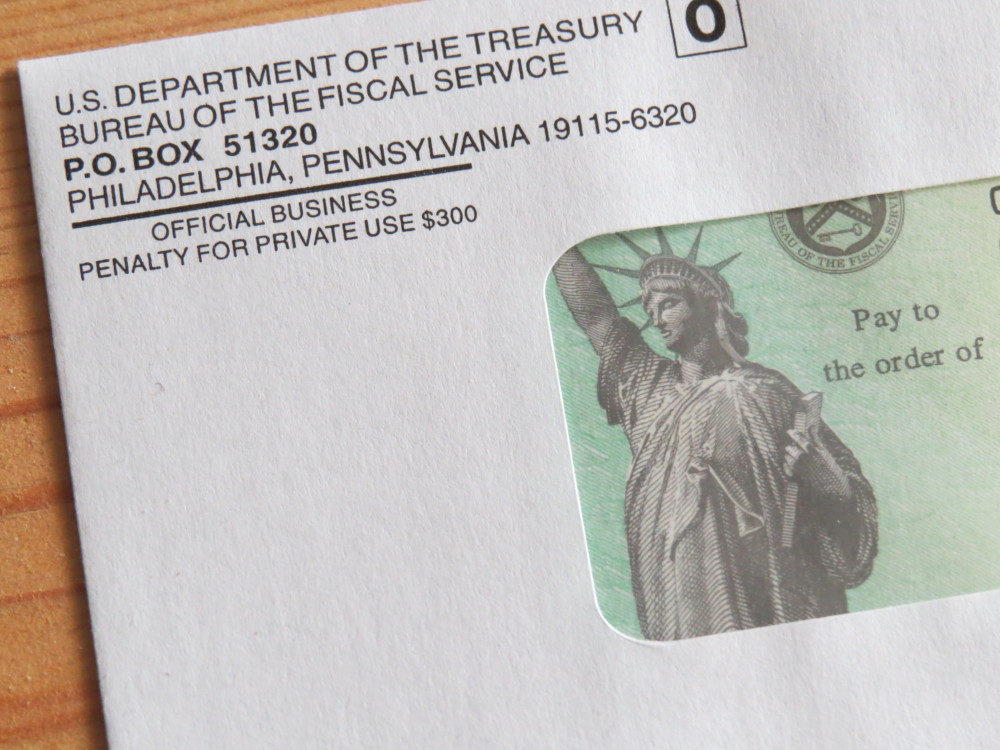

And now, payments of $1,400 per person are officially due to be sent March 17 (direct deposit), the week of March 22 (paper checks) and the week of March 29 (EIP cards). What will you do with the money?

Last Thursday, President Joe Biden signed into law the $1.9 trillion American Rescue Plan which, in addition to boosting the amount of the relief payment, expanded eligibility to include dependents over age 16. To qualify for the full payments, adjusted gross income must be less than $75,000 for individuals and $150,000 for married couples filing jointly.

The government-issued checks have been popularly called “stimulus payments,” though the funds primarily have been intended to replace money lost in the collapse of the economy, rather than to stimulate demand.

People have been careful with the funds with every round, and it looks like they’ll play it pretty safe this time too:

Limited spending: Much of $1,200 checks issued in the first round, as part of the CARES Act, did not generate spending sprees. The National Bureau of Economic Research found that almost 60% of the money went to pay down debt or into savings.

Researchers at the University of Chicago found that households on average spent 40% of the first check, mostly for food, beauty items and other products that people hoarded in the early days of the pandemic. Little went to purchases like cars or appliances.

Economists reasoned that with lockdowns in place last spring, there were far fewer options for spending the money.

One other factor to watch this time, given the size of the checks: Economists say that the greater the check, the less likely people are to spend it.

Bill paying: A survey in early January by Bankrate.com found that 71% of people said the second-round $600 checks they expected to receive for every adult and dependent child in a household would only sustain their financial well-being for less than a month. Four in 10 people surveyed said they would put the funds toward monthly bills such as rent or mortgage payments and utility bills.

Erasing debt: Almost 5 million people in Illinois age 18 and older said someone in their house received a relief payment in the previous seven days, according to data collected by the Census Bureau between Feb. 17 and March 1. Of those who detailed their plans, almost 2.4 million said it would be mostly be used to pay off debt.

Saving: With the third round of relief payments, Bank of America anticipates more of the funds will be saved in one way or another, not spent. In its survey of 3,000 people in late February, only 36% of respondents said they planned to spend the money. The rest had other plans: 9% planned to invest it, 25% would save it and 30% would use it to pay off debts.

It’s not good news for sellers of food, clothing and other necessities. Planned use of the money in those categories is anticipated to be down almost 5% from what people planned to do with the payments last year. One bright spot is vacation and travel, which saw big gains compared with earlier surveys but it was still a small part of overall picture.

Bank of America found that every household income group planned to save much more than normal. Among high earners, people with household incomes of more than $120,000, 79% said they either planned to save it, pay off debts or invest it. That same sentiment was echoed by 53% of people surveyed who had household incomes of less than $30,000. The lower-income group also reported the highest intentions of spending it on food, clothing and other needed purchasers.

Buying stocks: Some recipients have their eye on the stock market. A survey of 430 retail investors by Deutsche Bank last month found that half of those surveyed between the ages of 25 and 34 plan to buy stocks with half of their checks.

Distributed by Tribune Content Agency, LLC.