By Caroline McMillan Portillo

The Charlotte Observer.

CHARLOTTE, N.C.

The word of the day was “fit.”

And if you’re considering whether to buy and run a franchise, there are several “fit” criteria you need to consider, according to a group of five panelists who spoke at ShopTalk’s breakfast event Tuesday, all discussing what’s involved in taking that route to small-business ownership.

The event, called “Franchising: Picking the one right for you,” drew a sellout crowd of more than 120 people. Most of the attendees were considering whether to buy into an existing brand and business model or go at it on their own.

The panel of experienced entrepreneurs offering advice ranged from the man who initiated TCBY’s self-serve trend, to a former Carolina Panther who opened Charlotte’s first Tropical Smoothie Cafe, to a franchise expert who’s worked with hundreds of prospective and existing owners.

According to our panelists, ask yourself these three questions before deciding if buying into a franchise is the best fit for your path to entrepreneurship:

Is your nest egg flush and secure?

Before you even begin considering whether a franchise is the right business to own, consider whether becoming an entrepreneur is even right for you, said panelist Randy Mitchell of The Entrepreneur’s Source, a franchise itself that offers business coaching to franchisees and prospective franchise owners.

And a lot of that is going to come down to financing.

When you buy a franchise, you have to pay an upfront “franchise fee.” The one-time fee is in exchange for the rights to a protected territory and all of the training and materials that are involved in opening the business – “the knowledge, the training, the secret sauce,” Mitchell said.

Those fees can range between $20,000 and $50,000, Mitchell said. Some can be lower, but rarely are they higher.

Then there’s the rest of the investment: building out a store, buying inventory, marketing, hiring and more.

So for a store-front business, you’re usually looking at a total investment of about $120,000, Mitchell said. But it can be well under $100,000 for a mobile or home-based franchise.

Then, most franchises require that you pay royalties, usually a percentage of sales.

You don’t have to have all of that money in the bank, the panelists said, but financing isn’t always easy.

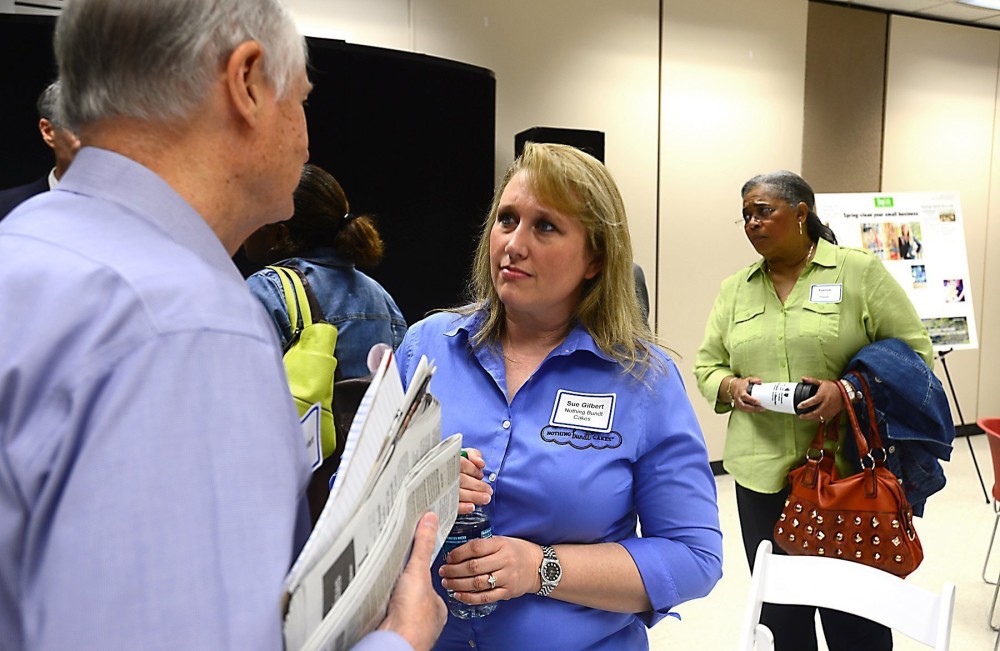

Sue Gilbert, who opened the Charlotte area’s first Nothing Bundt Cakes franchise, said she and her husband were able to take advantage of a program through Guidant Financial that allowed them to roll her husband’s 401(k) savings into the business, which had startup costs of about $300,000 to $400,000.

Do you prefer blueprints or innovation?

Gilbert said the prescriptive nature of the Nothing Bundt Cakes franchise model was one of the key reasons she was attracted to it; it took the guesswork out of the business strategy.

It also offered a blueprint for how to run the business. For example, every Nothing Bundt Cakes franchise follows the same recipes, has chic yellow walls with blue and cream accents, and colorful merchandise for sale.

“It’s a huge step to go out on your own,” Gilbert said, “and even though a franchise will not promise you that you will be successful, they have a lot of the foundations and building blocks to help you become successful.

TCBY franchise owner Sam Batt, on the other hand, initiated the TCBY self-serve trend and now owns 16 locations in the Charlotte market.

He opened the company’s first shop with a self-serve style in April 2010 to such great success (within three weeks, his location was one of the top-five most profitable franchises in the country), that the company embraced the trend and credits Batt with the move that reinvigorated the company and led to exponential growth.

Now, nearly every TCBY that opens has a self-serve model, and many franchisees with the classic served-behind-the-counter setup have changed their model to accommodate the trend.

But Batt’s experience with TCBY is truly the exception to the rule, said Mitchell with The Entrepreneur’s Source.

Don’t buy into a franchise thinking you’ll reinvent it, Mitchell said. Because in all likelihood, “they’re going to say, ‘Thank you very much, but spare us your brilliance.’ ”

Does your passion align with the company’s mission?

Former Panther defensive end Everette Brown, 27, who opened Charlotte’s first Tropical Smoothie Cafe, said he’s been an enthusiast of the brand since 2005, when he was a freshman at Florida State University.

He came upon the fast-casual restaurant, with 365 locations nationwide, which serves smoothies as well as breakfast, lunch and dinner. According to the company, the menu is designed to “inspire healthy lifestyles.”

Brown, who also started the Everette Brown Bag Foundation to fight childhood obesity, said that business strategy aligned with his guiding principles.

Another reason to care about the mission, other than the financial investment? No matter what kind of business you run, it’s going to require a significant investment of time as well, all panelists agreed.

Ben Knight, who owns three FASTSIGNS franchises, which make everything from “for sale” signs on manicured front lawns, to way-finding signs for universities and corporations, to “coming soon” wall wraps for retailers at shopping malls, said he worked nonstop when he first took over the existing FASTSIGNS South Tryon location.

Now that he’s got a better handle on operations and a trusted team he can delegate to, his schedule has eased up a bit, to “half days.”

“Doesn’t matter which 12 hours you work,” he quipped.