By Rex Crum

The Mercury News

WWR Article Summary (tl;dr) Investors weren’t enthusiastic about Meg Whitman’s planned departure, as Hewlett Packard shares fell 6.4 percent, to $13.22, in after-hours trading following the announcement.

PALO ALTO, Calif.

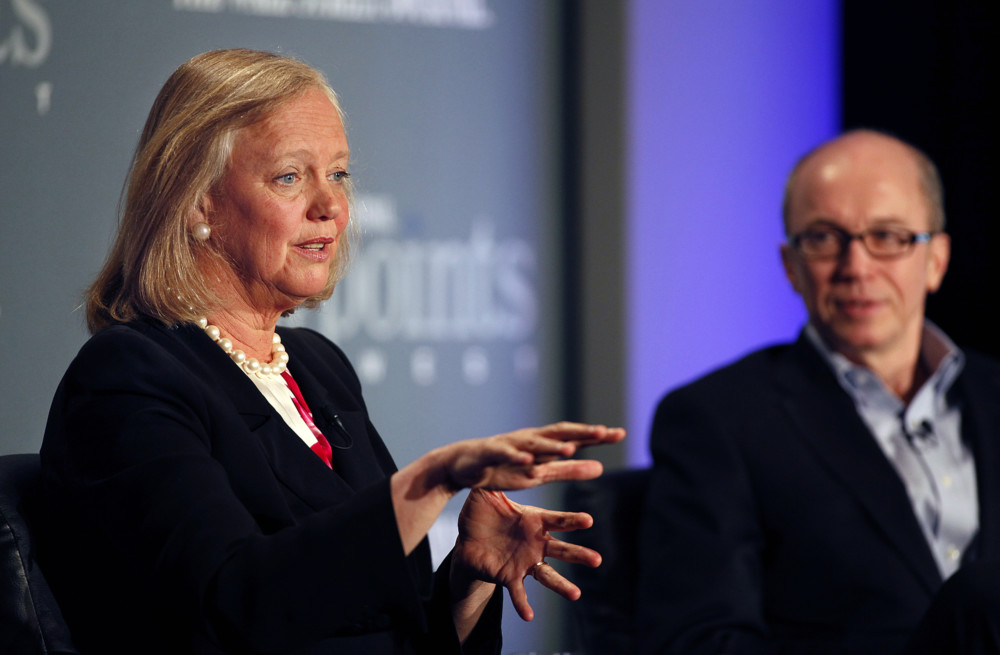

Hewlett Packard Enterprise said Tuesday that Meg Whitman will step down as the tech giant’s chief executive next February, after a nearly seven-year-long roller-coaster term that included a controversial splitting up of Hewlett-Packard, once considered to be the original Silicon Valley startup.

Whitman will stay on the job until Feb. 1, when HPE President Antonio Neri will take over as the company’s CEO. Neri will also join HPE’s board of directors, and Whitman will remain as an HPE director.

On a conference call, Whitman called her time at HPE “the privilege of a lifetime,” but said it was the “right time” for Neri and new leadership to run HPE.

“Today, Hewlett Packard moves forward as four industry-leading companies that are each well-positioned to win in their respective markets,” Whitman said. “We’ve laid out a strong foundation for a prosperous future.”

Investors weren’t enthusiastic about Whitman’s planned departure, as HPE shares fell 6.4 percent, to $13.22, in after-hours trading following the announcement. Daniel Ives, chief strategy officer and head of technology research at GBH Insights, said the initial negative reaction wasn’t shocking, as it will take some time for Wall Street to asses the HPE’s executive shakeup.

However, Ives said that for many HPE watchers, Whitman’s decision to leave the company can only be seen as a surprise.

“Many believed Meg was just in the middle innings of turning HPE around,” Ives said. “However she has led some heavy lifting that in some ways makes this the right time to leave the company.”

Whitman’s planned departure also appeared curious in light of her recent comments about her career plans.

During the summer, reports surfaced that said Whitman was a finalist to become CEO of ride-sharing giant Uber, but in late July Whitman took to Twitter to declare that she would not become Uber’s CEO.

“I am fully committed to HPE and plan to remain the company’s CEO,” Whitman said at the time. “We have a lot of work still to do at HPE and I am not going anywhere.”

Yet, when asked on HPE’s conference call if she had a change of heart about her job over the last few months, Whitman said nothing about the company had swayed her feelings, other than the belief that its was time for a CEO with Neri’s skills to take over.

“There hasn’t been a change in (my) sentiment,” Whitman said. “What’s true is that Antonio is ready to take the reins. We’ve got a very good leadership bench.”

When asked about her future plans, Whitman shot down any speculation that she would be heading to an HPE rival.

“I love this company and would never go to a competitor,” Whitman said.

Whitman’s tenure at HPE, and the old Hewlett-Packard before, was marked by upheaval and change from the first day she became CEO.

Whitman, who ran eBay from 1998 until 2007, joined Hewlett-Packard’s board of directors in January 2011, just two months after a running as a Republican and losing to Jerry Brown in the California gubernatorial race.

In September 2011, Whitman took over as HP’s CEO following the brief tenure of Leo Apotheker. In September 2015, HP said it would lay off 33,000 employees as it prepared to split into two companies: the Whitman-led Hewlett Packard Enterprise, which took on responsibility for computer servers, storage, business services and most of HP’s software offerings, and HP Inc., which got the old company’s personal computer and printing businesses.

Since that separation, Whitman spent much of her time spinning off other HPE operations including enterprise services and software. The resulting HPE now deals mostly with servers and storage and networking products, in addition to financial and some tech services.

At the same time Whitman announced her departure from HPE, the company also delivered its fiscal fourth-quarter results. HPE said that for the period ending Oct. 31, it earned 29 cents a share, on sales of $7.66 billion, compared with profit of 61 cents a share, on $7.3 billion in revenue in the same period a year ago. Wall Street analysts had forecast HPE to earn 28 cents a share on $7.78 billion in sales for its fourth quarter.

On the whole, Whitman’s business focus has yielded mixed results for HPE. During the company’s fourth quarter, servers made up the largest piece of the company’s business, with $3.28 billion in revenue. However, that figure fell 5 percent from a year ago.

Technology services revenue rose just 2 percent, to $2.02 billion, but storage sales rose 5 percent, to $871 million.

The brightest spots came from HPE’s networking business, which saw revenue rise 21 percent, to $678 million, and financial services, up 24 percent from a year ago, to $1.01 billion.

“Year over year HPE has been looking pretty bad, but the last two quarters have shown enough improvement to suggest that the light at the end of this tunnel isn’t a train,” said Rob Enderle, president to technology research firm the Enderle Group. “It also suggests that HPE is out of the woods and on a path to improvement going forward because the operational leadership seems to be managing effectively again.”

For its first quarter, HPE estimates it will earn 20 cents to 24 cents a share, while analysts have estimated the company would earn 27 cents a share.