Erin Arvedlund

The Philadelphia Inquirer

WWR Article Summary (tl;dr) Erin Arvedlund maps who is most likely to receive a third stimulus payment and when those checks may arrive.

Philadelphia

—Who’s getting a third stimulus check in 2021?

The third round of $1,400 payments would go to single people who earned up to $75,000 and $2,800 would go to couples who earned up to $150,000.

Payments would taper down for those incomes above those limits and and phase out completely above $100,000 and $200,000, for individuals and couples, respectively. The limits are tentative at this point.

It’s possible that parts of President Joe Biden’s stimulus plan will change before it’s brought to a vote, which is expected to start in the House of Representatives on the week of Feb. 22.

“The House is moving forward with these income limits, but until it’s signed, there’s always room for change,” said Lisa Borrelli, wealth tax and estate planner at WSFS.

—Why the phaseout?

America’s lower-wage workers suffered most. Pew Research Center defines middle-income households as those making $48,500 to $145,500 in 2018. In a survey around the pandemic, Pew found that 36% of lower-income adults and 28% of middle-income adults reported losing a job or taking a pay cut due to the pandemic, compared with 22% of upper-income adults.

—Will dependents get checks this time?

Yes. President Biden’s proposal would earmark an additional $1,400 per child dependent, to be added onto the checks of their parents or guardians, according to the latest version, said Borrelli.

This could mean money for around 13.5 million college students.

This contrasts with the first stimulus, where anyone claimed as a dependent, age 16 or under, got no money.

—When will we get our money?

Possibly late March.

The House of Representatives is expected to bring the proposal to a vote the week of Feb. 22. The Senate then has to vote, and any final package likely will be signed by Biden in mid-March.

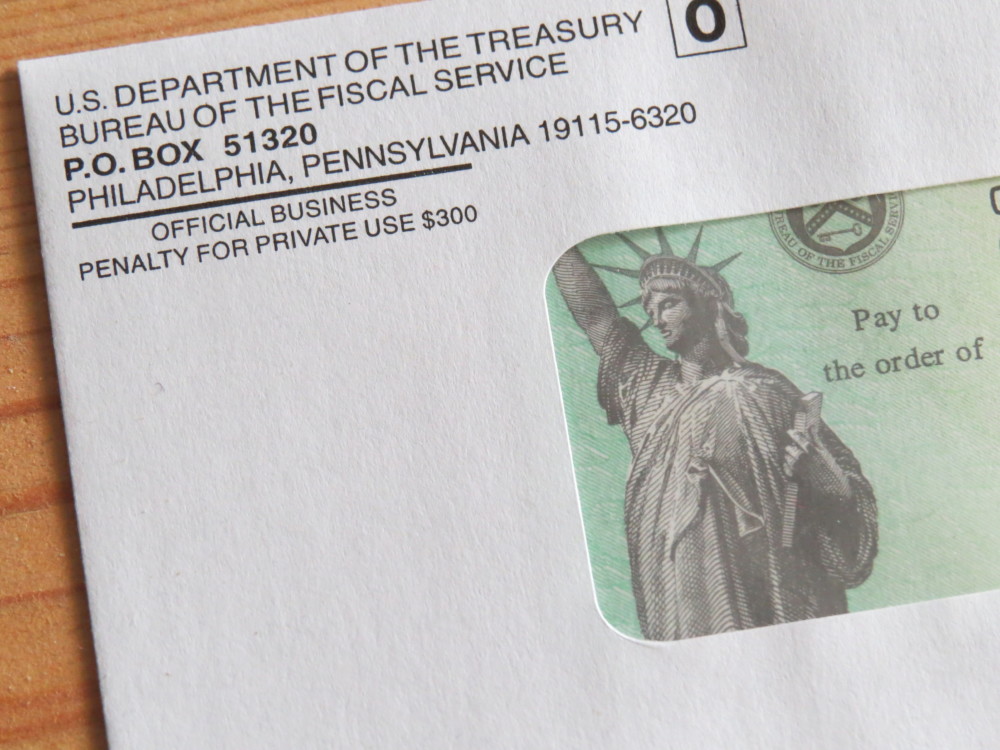

Days after signature, checks and debit cards go out in the mail or into banks accounts through direct deposit.

“Congress wants the money in our hands as soon as possible,” said Karolyn Banks, managing associate and CPA at Drucker & Scacetti.

—Whom do I call about my stimulus check?

Visit the IRS website first. There’s a special link to find out if you’re eligible and how much you should receive: www.irs.gov/coronavirus/get-my-payment.

You’ll be asked for your Social Security number or taxpayer ID number.

Calling the IRS could take much longer.

“You’re better off just going to the website,” said Banks. “The IRS has been backed up for months and many [employees] are still working remotely.”

—Why another round of stimulus checks?

After receiving the most recent $600 checks, lower-income households significantly increased spending, according to a paper by Opportunity Insights Economic Tracker pinpointing how stimulus payments help consumers.

Some small business owners are surviving on stimulus checks as well, said Jennifer Rodríguez, president and CEO of the Greater Philadelphia Hispanic Chamber of Commerce.

“In my discussions with commercial corridor managers, I learned that many of the business owners were relying on stimulus checks to support them because they were either not eligible or unable to access relief funds,” she said.

—Didn’t get any stimulus money in 2020? You may be entitled to a tax rebate.

Did you qualify for Economic Impact Payments and not receive any money in 2020?

Up to eight million households were entitled to payments but didn’t get those due to processing delays and problems with their applications, a recent Treasury fact sheet estimated.

If you didn’t receive the first or second round of stimulus, and were eligible under the income limits, you’re allowed to take a credit against your 2020 taxes, said Mary Lew Kehm, a CPA in Whitehall, Pa., and tax expert who blogs at www.speakingoftaxes.net.

It’s up to taxpayers and their accountants to determine how much.

To claim your credit, fill out a Recovery Rebate Credit form. Here’s a link to the 2020 Form 1040: www.irs.gov/pub/irs-pdf/f1040.pdf. The rebate is claimed on line 30.

For more information, visit the IRS economic impact website at www.irs.gov and the IRS Taxpayer Advocate’s website.

—Can my stimulus money be garnished for overdue child support?

Yes.

“It’s pretty much the only reason that your stimulus money can be garnished. Any other debts, such as back taxes, can’t be reasons to garnish your check,” said Banks.

—Will Social Security recipients receive a third stimulus check?

Yes.

“This is for everyone who has earned income and filed taxes and there’s language in the bill to expand to non-citizen spouses who are U.S. residents,” Borrelli said. “But that’s not final.”

Distributed by Tribune Content Agency, LLC.