By Ryan Faughnder

Los Angeles Times

WWR Article Summary (tl;dr) If the deal goes through, former SBA Chief Maria Contreras-Sweet could become chairwoman of the Weinstein Co. board. As a condition of the deal with Contreras-Sweet and her financial backers, the company would have to set up a mediation process and litigation fund to compensate alleged victims of Weinstein.

Los Angeles Times

A former Obama administration official has submitted a bid to buy the Weinstein Co. and install a majority-female board of directors, in a surprising twist for the beleaguered film and television studio that has been trying to avoid bankruptcy.

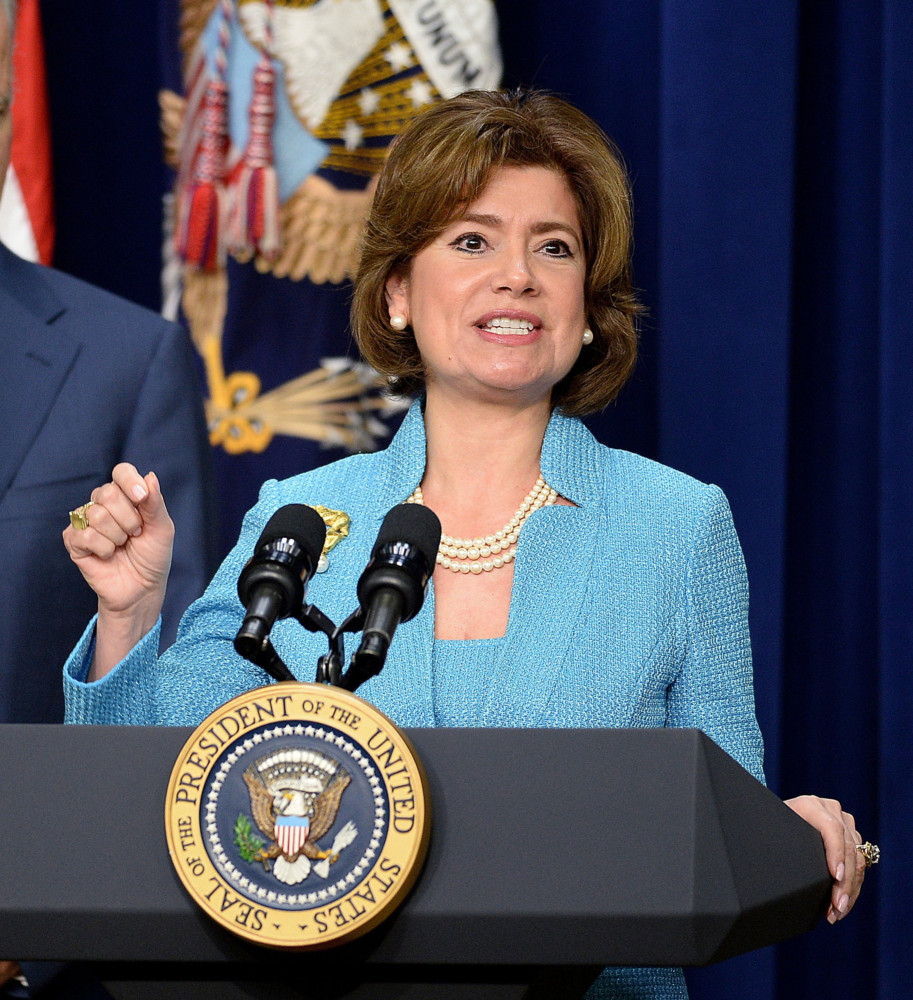

Maria Contreras-Sweet, who ran the U.S. Small Business Administration from 2014 to 2017, sent a letter to the Weinstein Co. board of directors this month offering to buy the company and assume liabilities related to its business operations.

Contreras-Sweet would become chairwoman of the Weinstein Co. board, according to a copy of the letter obtained by The Los Angeles Times. Her letter, first reported by the Wall Street Journal, did not include financial details.

“I believe we have now reached a crossroads where it is imperative that a woman-led board acquire control of the company and create content that continues to inspire audiences around the world, especially our young girls and boys,” Contreras-Sweet said in the Nov. 8 letter.

Weinstein Co. representatives did not respond to requests for comment.

Such a deal would be a remarkable development for the onetime independent film powerhouse, which has spent more than a month confronting sexual harassment and assault allegations against its co-founder Harvey Weinstein.

Last week, Weinstein Co. got a much-needed financial lifeline when it sold its North American distribution rights for “Paddington 2” to Warner Bros. in a deal worth about $30 million, which it split with French-owned StudioCanal.

People close to the studio said the money will help keep Weinstein Co. out of Chapter 11 bankruptcy protection as it explores options.

Previous attempts to secure financing for the studio had fallen through. Thomas Barrack’s private equity firm Colony Capital backed out of talks to buy the company. Weinstein Co. was close to getting an emergency loan from Fortress Investment Group, but no such agreement materialized.

As a condition of a deal with Contreras-Sweet and her financial backers, the company would have to set up a mediation process and litigation fund to compensate alleged victims of Weinstein, the letter said.

According to the letter, Contreras-Sweet and her financial backers discussed their proposal with attorney Gloria Allred, who represents several of Weinstein’s accusers. Last week, an anonymous actress represented by Allred sued Weinstein and the company for battery and assault.

Separately, a class-action lawsuit was filed against the company on behalf of dozens of women accusing Weinstein of sexual assault, battery and lewd conduct.

Allred, in a statement, said she supports the Contreras-Sweet bid.

“Saving the company will benefit employees, shareholders, vendors and if her proposal is accepted, it will be very important to victims,” Allred said.

Contreras-Sweet was born in Guadalajara, Mexico, and came to the U.S. with her mother and five siblings when she was 5. In 2006, she founded ProAmerica Bank, which was developed to support small and medium-sized businesses, especially in the Latino community.